The First AI-Powered Real-Time Risk Assurance Platform is Here

Unique Transaction Quality Monitoring System™

Eliminates Capital Leakage and Makes Compliance Frictionless

Today, you have data scattered across silos that are brought together with manual processes or as part of workflow automations. Either way, these tools and processes bring a ton of data to you over and over, but then you're on your own or relying on Excel or forced to go into the next GRC system to try and make sense of the data - just to find all of the risks and capital leakage. You might even get lucky and find some, but let's face it: these labor-intensive processes result in attrition as well as capital leakage.

Now those days are over.

Solve your Problem of Multiple Silos Connectivity and Enabling Data Driven Finance - without a Big Data Science Team or Long, Expensive Multiple Enterprise System Deployments

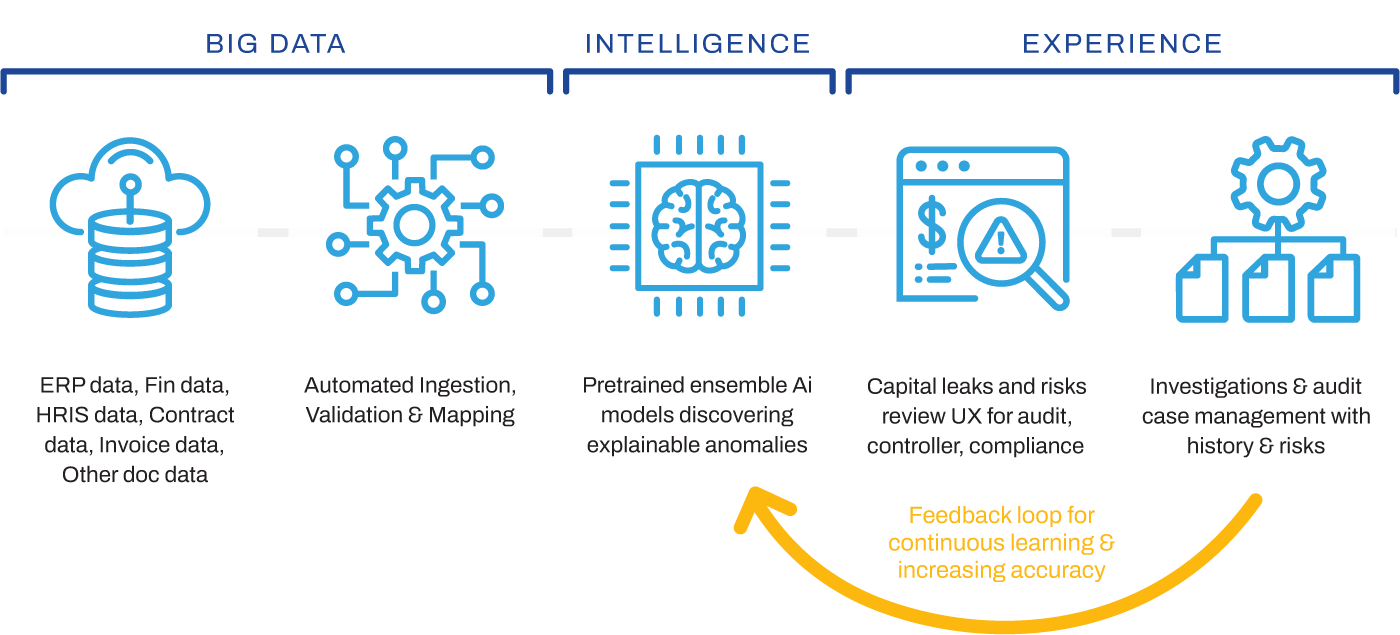

ThinkRisk brings data together across enterprise silos and combines pre-trained AI models, domain expertise and business context to identify risks, eliminate capital leakage, improve compliance, and increase the integrity of financial records.

It is the only cloud native AI platform that provides autonomous risk assurance across all financial processes through a single integrated environment that is built for the finance community with Big Data, AI-Driven Intelligence and User-Centric Design to enable a unique experience.

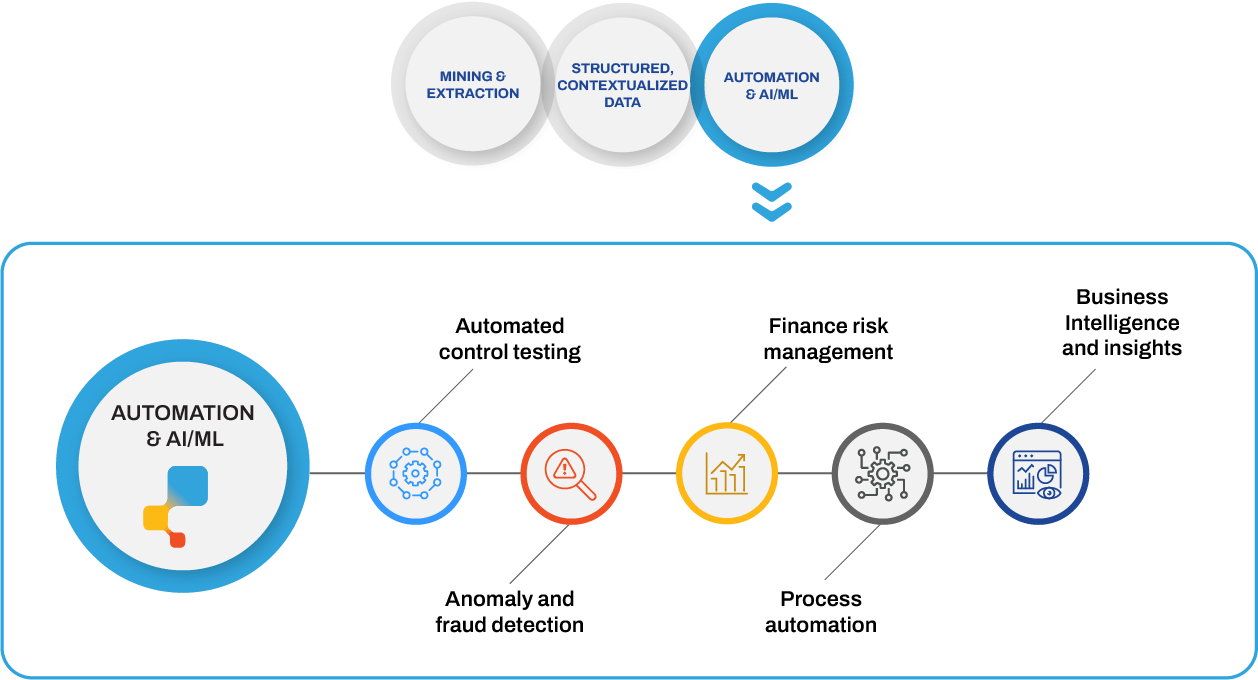

Through its patent pending Transaction Quality Monitoring system (TQM), ThinkRisk eliminates transactional anomalies in financial datasets. TQM enables proactive detection of anomalies and risks and early intervention so their impact on the business is minimized.

TQM Engine

Domain-curated Big Data capability enables seamless integration from multiple enterprise data sources and automated ingestion, processing, and insights for users to enable continuous risk assurance.

TQM Engine Technology is a unique combination of pre-trained machine learning ensemble models that have the lowest rate of false positives vs. all existing tools and alternatives – as proven by many Fortune 100 customers across industries. Beyond the highest levels out of accuracy out of the box, the TQM Engine has reinforcement learning that continuously gathers feedback to improve anomaly detection accuracy and the prevention of capital leakage by empowering Audit, Accounts, Operations, and Controllers across the enterprise – to proactively detect and mitigate risks and anomalies across financial data sets at scale.

Risk and Fraud Investigations are easily launched in the same integrated environment, when detected. Users not only have visibility into the risk insights across books of business in real-time, but also have ready access to the audit trail of historical risks, their mitigations and involved parties. This 360-degree visibility on risk and frauds empower our user community to proactively identify and eliminate capital leakage.

ThinkRisk Benefits

Now You Can Analyze All of Your Accounting Transactions to Identify and Manage Financial Risks

- Informed Mitigation & Decision Making

- Clear and actionable risk insights of the identified anomalies are delivered to the process teams so they can take timely action

- “Plug-and-Play”

- Solution that seamlessly integrates with major ERPs and accounting systems to rapidly realize ROI and optimize inefficiencies

- Wider Assurance

- Purpose-built AI platform analyzes 100% of your transactions to deliver clear and actionable risk insights, increasing trust in your financial statements

- Scalable

- ThinkRisk's SaaS platform is scalable across business processes to address all your transactional risks

- Enhanced Efficiency

- Quickly automates the extraction, cleansing and normalization of large volumes of data from ERP systems to provide more efficient outcomes

- Single Source of Truth

- By applying a robust data ingestion layer automated financial transactional data aggregation from across the enterprise landscape creates a single version of truth.

- Cost-of-Compliance Optimization

- Continuously tests internal controls to reflect the health and effectiveness of compliance activities (SOX testing) reducing compliance costs

- Always-On Anomaly Detection

- Real-time discovery of transactional anomalies and risk identify those that warrant human attention before they matter

- Proactive Control Monitoring

- ThinkRisk provides pre-built analytical components for proactive control monitoring

- Fast Onboarding

- Organizations are onboarded to our true enterprise SaaS transaction analysis platform in as little as two weeks - so value is realized almost immediately

Reduce Fraud, Errors, and Non-Compliance to Deliver Better Outcomes

Now you can stop spending 80% of your time manually gathering, verifying, and consolidating data because ThinkRisk identifies the fraudulent transactions that consistently “fly under the radar” and went undetected previously.

ThinkRisk Features

- Real-time quality monitoring of 100% of transactions

- Proactively identify anomalies such as processing errors, irregularities, fraud, and noncompliance

- Applies AI, machine learning, and natural language processing to deliver a future-ready solution that can scale rapidly

- Detects, dissects, and flags exceptions across policy, regulatory, and fraud-risk areas

- Proprietary continuous learning algorithms reduce false positives

- Explainable anomalies and actions tracking enhance compliance and traceability

- Interactive dashboards drive increased visibility of transaction quality and business impact

- Institutional memory of risks addressed provide recommendations for remediation

500% More Accuracy Than Existing Solutions

You can rely on ThinkRisk to automate data consolidation, financial risk, and compliance monitoring in addition to financial performance management with up to 75% less effort - freeing finance and audit teams to focus more on strategic and higher-value mission-critical tasks.